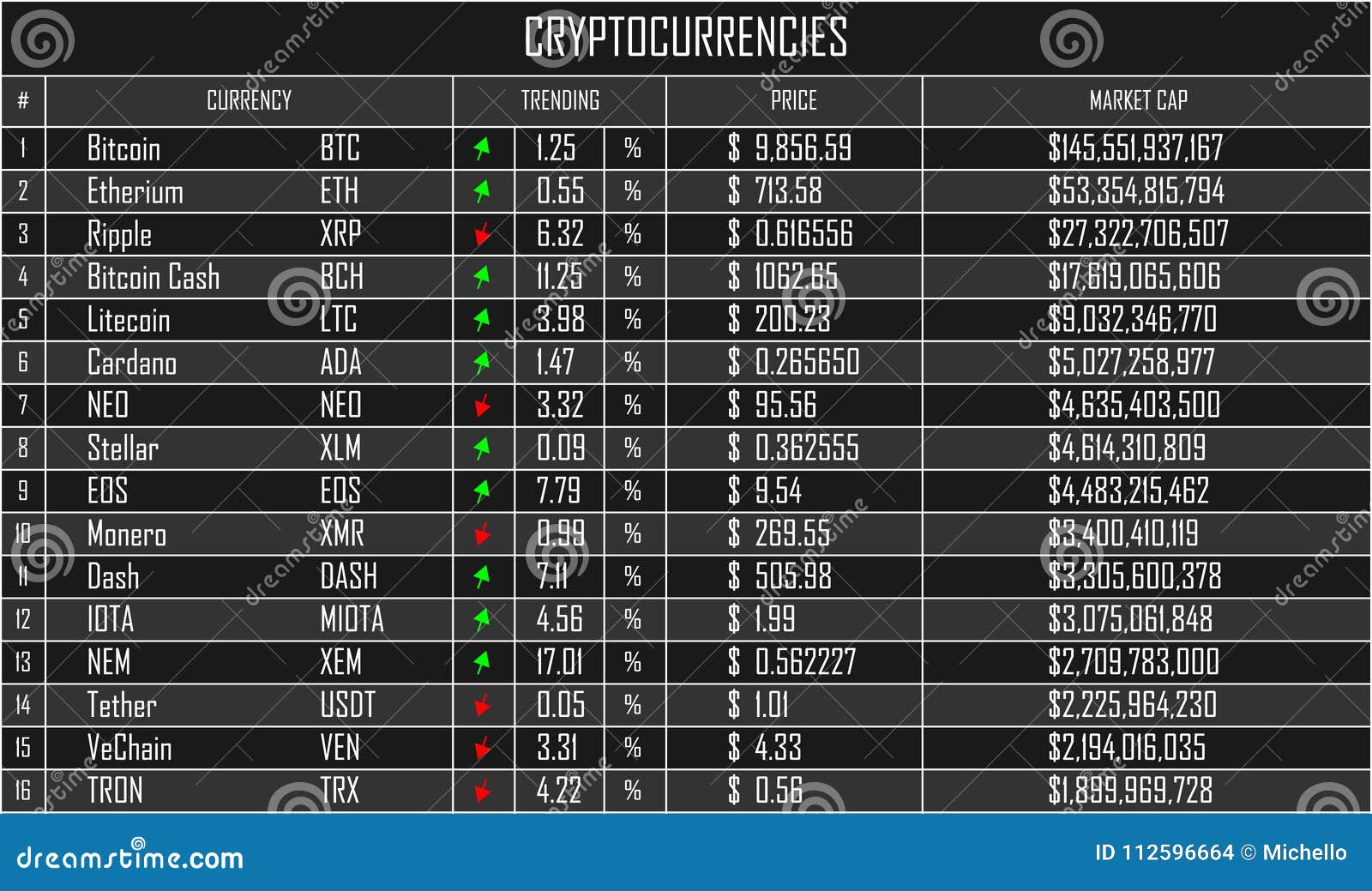

- List of all cryptocurrencies

- What are all the cryptocurrencies

- Why do all cryptocurrencies rise and fall together

List of all cryptocurrencies

Another blockchain innovation are self-executing contracts commonly called “smart contracts.” These digital contracts are enacted automatically once conditions are met aussie play. For instance, a payment for a good might be released instantly once the buyer and seller have met all specified parameters for a deal.

The Ethereum blockchain is not likely to be hacked either—again, the attackers would need to control more than half of the blockchain’s staked ether. As of September 2024, over 33.8 million ETH has been staked by more than one million validators. An attacker or a group would need to own over 17 million ETH, and be randomly selected to validate blocks enough times to get their blocks implemented.

Even if you make your deposit during business hours, the transaction can still take one to three days to verify due to the sheer volume of transactions that banks need to settle. Blockchain, on the other hand, never sleeps.

List of all cryptocurrencies

Almost. We have a process that we use to verify assets. Once verified, we create a coin description page like this. The world of crypto now contains many coins and tokens that we feel unable to verify. In those situations, our Dexscan product lists them automatically by taking on-chain data for newly created smart contracts. We do not cover every chain, but at the time of writing we track the top 70 crypto chains, which means that we list more than 97% of all tokens.

Almost. We have a process that we use to verify assets. Once verified, we create a coin description page like this. The world of crypto now contains many coins and tokens that we feel unable to verify. In those situations, our Dexscan product lists them automatically by taking on-chain data for newly created smart contracts. We do not cover every chain, but at the time of writing we track the top 70 crypto chains, which means that we list more than 97% of all tokens.

Related Links Are you ready to learn more? Visit our glossary and crypto learning center. Are you interested in the scope of crypto assets? Investigate our list of cryptocurrency categories. Are you interested in knowing which the hottest dex pairs are currently?

The UK’s Financial Conduct Authority estimated there were over 20,000 different cryptocurrencies by the start of 2023, although many of these were no longer traded and would never grow to a significant size.

In January 2024 the SEC approved 11 exchange traded funds to invest in Bitcoin. There were already a number of Bitcoin ETFs available in other countries, but this change allowed them to be available to retail investors in the United States. This opens the way for a much wider range of investors to be able to add some exposure to cryptocurrency in their portfolios.

Each of our coin data pages has a graph that shows both the current and historic price information for the coin or token. Normally, the graph starts at the launch of the asset, but it is possible to select specific to and from dates to customize the chart to your own needs. These charts and their information are free to visitors of our website. The most experienced and professional traders often choose to use the best crypto API on the market. Our API enables millions of calls to track current prices and to also investigate historic prices and is used by some of the largest crypto exchanges and financial institutions in the world. CoinMarketCap also provides data about the most successful traders for you to monitor. We also provide data about the latest trending cryptos and trending DEX pairs.

What are all the cryptocurrencies

Almost. We have a process that we use to verify assets. Once verified, we create a coin description page like this. The world of crypto now contains many coins and tokens that we feel unable to verify. In those situations, our Dexscan product lists them automatically by taking on-chain data for newly created smart contracts. We do not cover every chain, but at the time of writing we track the top 70 crypto chains, which means that we list more than 97% of all tokens.

NFTs are multi-use images that are stored on a blockchain. They can be used as art, a way to share QR codes, ticketing and many more things. The first breakout use was for art, with projects like CryptoPunks and Bored Ape Yacht Club gaining large followings. We also list all of the top NFT collections available, including the related NFT coins and tokens.. We collect latest sale and transaction data, plus upcoming NFT collection launches onchain. NFTs are a new and innovative part of the crypto ecosystem that have the potential to change and update many business models for the Web 3 world.

Play-to-earn (P2E) games, also known as GameFi, has emerged as an extremely popular category in the crypto space. It combines non-fungible tokens (NFT), in-game crypto tokens, decentralized finance (DeFi) elements and sometimes even metaverse applications. Players have an opportunity to generate revenue by giving their time (and sometimes capital) and playing these games.

In January 2024 the SEC approved 11 exchange traded funds to invest in Bitcoin. There were already a number of Bitcoin ETFs available in other countries, but this change allowed them to be available to retail investors in the United States. This opens the way for a much wider range of investors to be able to add some exposure to cryptocurrency in their portfolios.

Why do all cryptocurrencies rise and fall together

Emerging markets, where inflation and currency devaluation are common, have embraced Bitcoin as a financial safeguard. This trend reinforces its position as a viable alternative to traditional assets during economic uncertainty.

Forks can also lead to uncertainty. When a blockchain splits into two versions, investors may hesitate, unsure of which version will gain traction. Bitcoin Cash, created from a bitcoin fork in 2017, saw initial volatility before stabilizing. Upcoming upgrades, like the Chang Hard Fork expected in 2024, are predicted to spark bullish trends based on historical patterns. These events demonstrate how technological changes can influence cryptocurrency prices both positively and negatively.

Bitcoin halving events are a perfect example of how supply and demand interact to influence prices. During a halving, the reward for mining bitcoin is cut in half, reducing the rate at which new coins are created. This reduction in supply often leads to significant price movements.

Global events and economic trends can create ripple effects in the cryptocurrency market. For instance, during the 2020 Covid pandemic, economic uncertainty caused Bitcoin’s price to drop by 42% as lockdowns disrupted economies. In contrast, record-low interest rates and fiscal policies in 2021 fueled a surge in liquidity, pushing Bitcoin to an all-time high. However, rate hikes in 2022-23 aimed at controlling inflation led to a 37.8% drop in Bitcoin’s price in June 2022.

However, not all policies lead to positive outcomes. When countries attempt to ban or heavily regulate cryptocurrencies, the market often reacts negatively. Political instability can also drive investors toward bitcoin as a safe-haven asset, causing fluctuations in its value. These examples highlight how closely the cryptocurrency market is tied to government decisions.